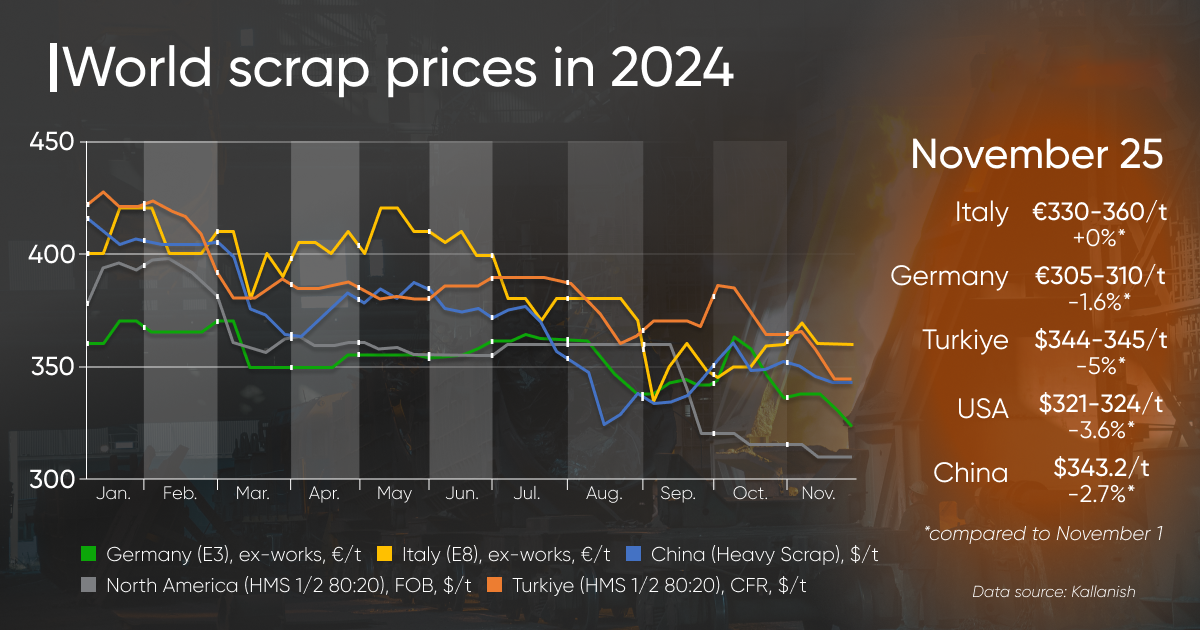

The global scrap market experienced a downward trend in prices across most major regions during the period from November 1 to 25, 2024. In Turkey, scrap supply dropped to its lowest level in two years, while prices in the US fell by 3.6%. The European market saw mixed trends, with overall stagnation. In China, scrap prices declined by 2.7%. A partial recovery is expected in January 2025.

Turkey's Scrap Market Faces Significant Drop

November 2024 marked a period of falling scrap prices in Turkey. Prices for HMS 1&2 80:20 materials fell by 5%, reaching $344–345 per ton (CFR), the lowest level seen in two years. This continued a downward trend that began in October (-1.4%), driven by oversupply and weak demand for steel.

At the beginning of November, the market remained weak due to an oversupply of scrap, particularly from the EU and the UK, which met the needs of Turkish steel mills. Although suppliers attempted to raise prices in response to rising freight costs and expectations of Chinese economic stimulus, Turkish mills resisted any price hikes. Deals were concluded at $355–360 per ton (CFR), but by the end of the first week, offers began to drop to $350–355 per ton (CFR).

Expectations surrounding Chinese economic incentives played a significant role in shaping market sentiment. However, following a limited stimulus package announced on November 8, optimism among suppliers faded. Turkish rebar prices continued their decline, dropping from $610–625 per ton to $595–615 per ton (ex-works) by mid-November.

The pace of the price decline accelerated in the second half of November. Deals for HMS 1&2 80:20 from the EU were concluded at $344–345 per ton (CFR), with Romanian scrap priced at $325 per ton (CFR). By November 20, prices for UK-origin scrap had fallen to $340 per ton (CFR), the lowest level since 2022.

Several factors contributed to this drop:

Despite the significant drop, market participants anticipate a recovery in January, when European demand is expected to pick up. However, the market will likely remain under pressure until the end of 2024, with steel mills having already met minimum demand for December and weak demand for steel limiting any substantial short-term increase in scrap prices.

Mixed Trends in the European Scrap Market

The European scrap market in November showed mixed results. After a downturn in autumn driven by weak demand and limited exports, the situation gradually stabilized, although challenges persisted due to sluggish demand for finished steel.

In Italy, scrap prices for E8 grades rose by €10–15 per ton in early November, reaching €325–370 per ton (ex-works). By mid-month, prices had stabilized at €330–360 per ton, with the lower end rising by €10 compared to November 1. This increase was driven by a demand recovery from local steel mills following the October price drop, positioning Italy as one of the cheapest scrap markets in Europe. However, the outlook remains fragile due to planned production stoppages at Italian factories in December, with some companies announcing up to 4 weeks of downtime, which could reduce demand and price stability.

In Germany, scrap prices for E3 dropped by €5–10 per ton, falling to €305–310 per ton, due to low domestic demand and limited exports, as Turkish mills reduced purchases. Economic stagnation in Germany further suppressed scrap demand.

Similar stability was seen in Austria, where prices remained steady at €300–305 per ton, with most market participants expecting this trend to continue until the end of the year.

In France, Belgium, and Luxembourg, scrap prices held relatively steady despite expectations of a decline due to weak Turkish demand. For example, E40 grades were sold for €335–340 per ton, and E8 grades for €320–335 per ton. Most European steel mills locked in prices in November, which helped maintain stability in the market.

Although some short-term positive price fluctuations were seen in certain European countries, the outlook for December remains uncertain, with pre-holiday production stoppages and reduced activity potentially altering price dynamics once again.

US Scrap Market Declines by 3.6% in November

In the US, scrap prices fell by 3.6% from November 1 to 25, reaching $321–324 per ton (FOB US East Coast). This decline was driven by weak demand, low export quotations, and falling steel prices.

At the start of November, market participants had hoped for price stabilization, but a reduction in contract orders from steel mills created uncertainty, especially in the Southeast US, where oversupply was a concern. In contrast, prices in the Midwest remained stable due to low steel inventories at mills.

The export market showed negative trends, with offers for HMS 1&2 80:20 from the US to Taiwan dropping to $310–320 per ton (CFR) due to weak rebar demand. Meanwhile, Turkey, the largest importer of US scrap, continued to lower its bids, preferring more affordable scrap from other regions.

Mid-November brought a mild price adjustment in the southeastern US, where prices fell by $10 per ton. Despite expectations that adverse weather and the holiday season could limit supplies, weak demand, particularly due to sluggish rolled steel sales, kept prices under pressure.

The market outlook for the remainder of November remains uncertain. Some participants expect that worsening weather conditions and preparations for winter could provide some support for prices, but weak export markets and low demand in Turkey continue to create additional pressure.

China's Scrap Market Sees a 2.7% Decline

In China, scrap prices (Heavy Scrap) fell by 2.7% from November 1 to 25, reaching $343.3 per ton. The primary reasons for the decline were lower domestic steel prices, oversupply, and limited demand from electric arc furnace (EAF) steel mills.

After a period of rapid growth in October, driven by rising steel prices, the market dynamics shifted in early November. Increased supply and an influx of material from downstream processors weighed on prices, limiting any potential recovery.

25th floor, C3 Building, Wanda Plaza, Kaifu District, Changsha, Hunan Province, China