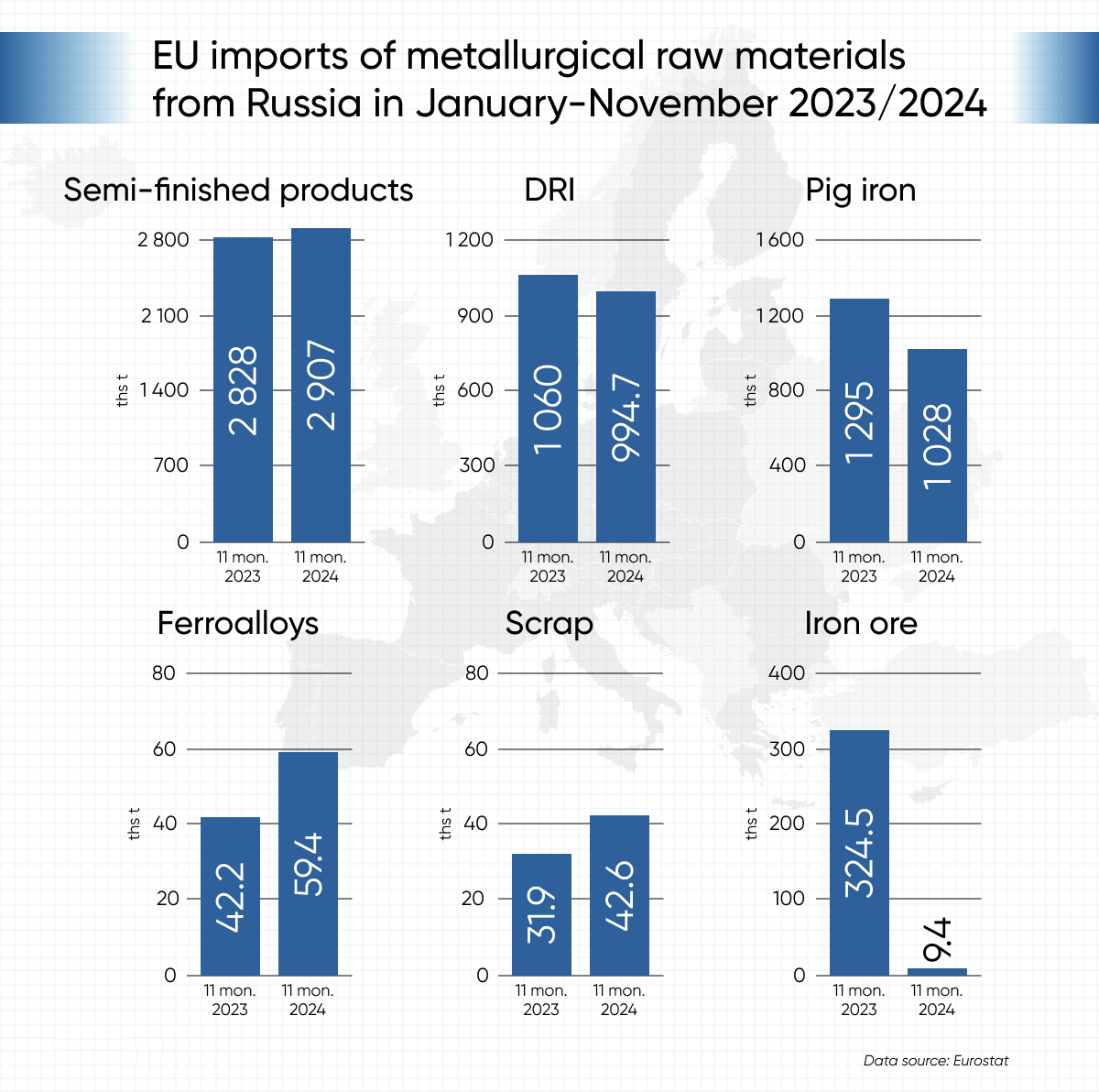

Between January and November 2024, the European Union imported 5.04 million tons of steel raw materials from Russia, valued at €2.39 billion. These imports primarily consisted of semi-finished products, pig iron, ferroalloys, scrap, and direct reduced iron, reflecting the ongoing dependence of EU steel plants on Russian supplies, often sold at discounted rates.

Semi-finished steel products, including slabs and billets, made up the largest portion of imports. A total of 2.91 million tons of these materials were shipped to the EU during this period, an increase of 2.8% year-over-year, with an import value of €1.48 billion. The key consumers of Russian semi-finished products included:

Pig iron imports amounted to 1.03 million tons, generating revenues of €420.3 million for Russian suppliers. Italy was the largest buyer, importing 768.91 thousand tons, followed by Latvia with 147.72 thousand tons (+91.5% y/y).

Russian ferroalloy exports to the EU rose by 40.9% year-over-year to 59.43 thousand tons, valued at €136.42 million (+19.2% y/y). The Netherlands accounted for over 77% of ferroalloy imports, at 45.95 thousand tons (+47% y/y).

Russian scrap steel shipments to the EU totaled 42.61 thousand tons, with procurement costs reaching €23.58 million. Meanwhile, iron ore imports were relatively minimal at 9.36 thousand tons, worth €1.33 million. Direct reduced iron (DRI) imports, however, were significant, with 994.65 thousand tons delivered for €333.05 million.

Despite the ongoing conflict in Ukraine and sanctions imposed on Russia, EU steel imports from Russia remain substantial. Russian producers have leveraged price discounts to maintain market share, and EU dependency persists due to the competitive pricing and the limited scope of sanctions. For example, the European Commission has relaxed restrictions on Russian slab imports, enabling continued trade. This precedent raises concerns about the potential easing of restrictions on pig iron imports.

As a candidate for EU membership, Ukraine has the opportunity to position itself as a key supplier to replace Russian steel products in the European market. This shift would align with the EU's broader strategic goals of reducing dependency on Russia.

In 2023, the EU reduced its imports of steel and mining products from Russia by 39.5% compared to 2022, with total volumes reaching 4.8 million tons. The value of these imports also dropped by 38.5% year-over-year, to €2.4 billion. Semi-finished products continued to dominate, accounting for 69.4% of total imports.

As EU policymakers weigh their options, the balance between maintaining supply chains and enforcing sanctions remains a critical issue for the region’s steel industry.

25th floor, C3 Building, Wanda Plaza, Kaifu District, Changsha, Hunan Province, China