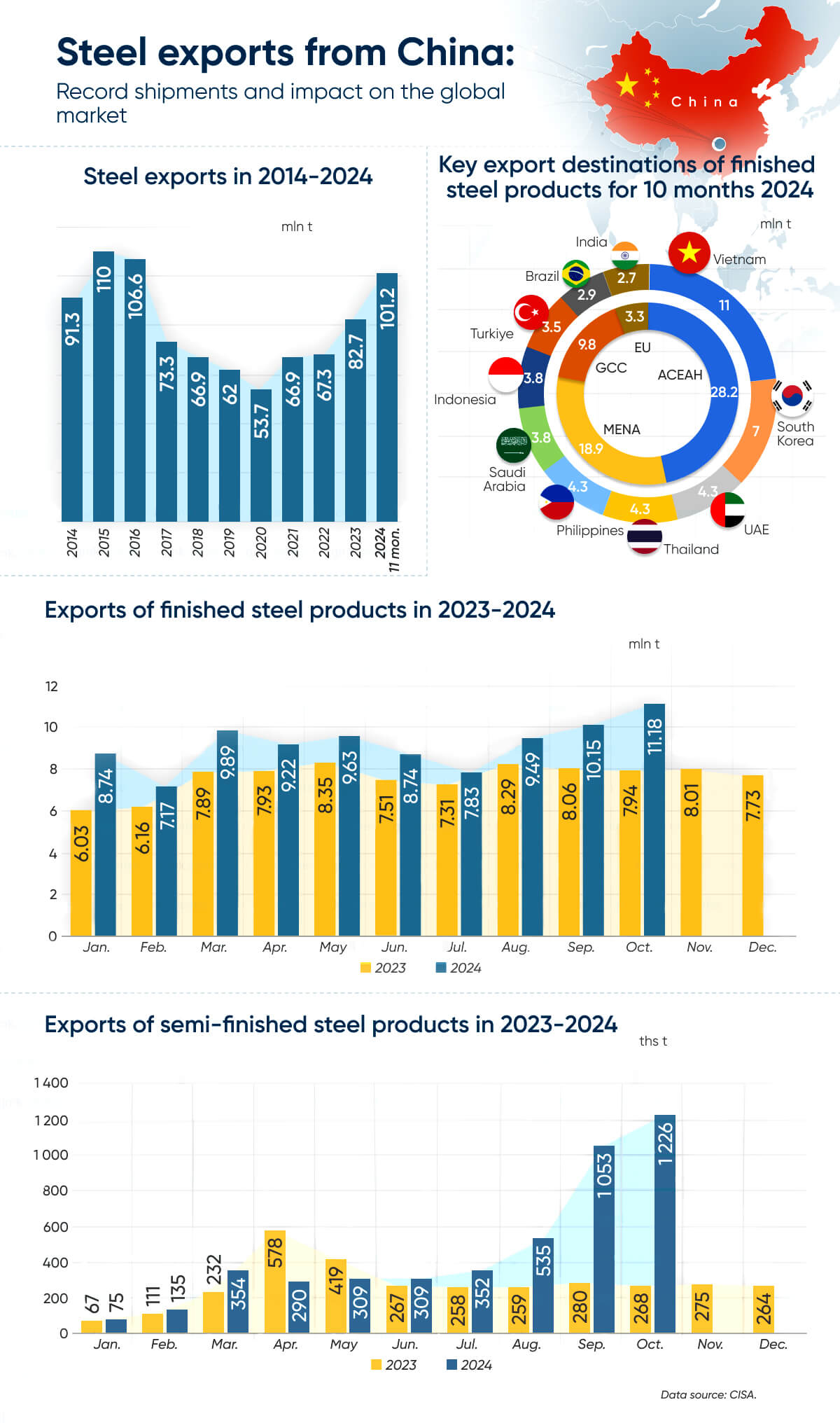

The global steel market is facing a flood of cheap Chinese steel, creating significant challenges for local producers worldwide. China's steel exports are on track to surpass the 2015 record of 110 million tons in 2024, potentially reaching over 111 million tons—a year-on-year increase of 23%. By the end of November, China had already exported 101.2 million tons, a sharp rise compared to the total 90.3 million tons exported in 2023. This surge marks a significant rebound from the relatively stable export levels of 66-67 million tons recorded during 2021-2022.

The sharp uptick in steel exports stems from a weakening domestic market, driven by economic challenges and a faltering construction sector. Despite government efforts to stimulate growth, construction activity in China continues to contract, forcing steel manufacturers to offload surplus production in foreign markets at prices that outcompete rivals.

Competitive Pricing Fuels Chinese Steel's Global Expansion

Chinese steel producers leverage large-scale production and lower labor costs to dominate the global market. Industry analysts estimate that Chinese steel products are 10-20% cheaper than those from competitors in the US, EU, or other Asian nations. This price advantage has enabled Chinese exporters to gain ground, especially in developing countries where industries lack sufficient protections against price dumping.

In the first 10 months of 2024, China's finished steel exports rose to 92.06 million tons, a 22% year-on-year increase, while semi-finished steel exports soared to 4.64 million tons, marking a staggering 69.3% growth year-on-year. The surge in shipments has been especially pronounced since the third quarter of the year. Exports of semi-finished products jumped from 70,000-300,000 tons at the start of the year to 1.05 million tons in September and 1.23 million tons in October.

Key destinations for finished steel products during this period included Vietnam, South Korea, the UAE, Thailand, and the Philippines, which collectively accounted for over 33% of total exports. Meanwhile, primary buyers of semi-finished steel products were Italy, Taiwan, Djibouti, Saudi Arabia, and Indonesia.

Protective Measures by Affected Countries

Countries experiencing a surge of low-cost Chinese steel imports are taking measures to safeguard their domestic producers. The European Union, for instance, has frequently imposed anti-dumping duties on Chinese steel and is now considering additional restrictions on specific product categories. Similarly, the United States maintains stringent tariffs of up to 25% on steel imports from China.

These protective policies have prompted Chinese steelmakers to ramp up exports before new restrictions come into force, contributing to the sharp rise in shipments over the past few months. Alongside trade barriers, some nations are focusing on modernizing their steel industries to enhance efficiency and competitiveness.

Global Challenges and Systemic Implications

The continued growth of China’s steel exports is exacerbating the global steel market's oversupply, with prices at risk of falling to their lowest levels in a decade. This poses systemic challenges for local steel producers worldwide, particularly in the EU and other regions.

Edison, CEO of Ronsco Inc., explains, “The key challenge for steelmakers in the EU and other regions is to find and develop their own competitive edge. Trade barriers and technical restrictions can only delay the problem. Ultimately, producers must focus on improving efficiency and cutting production costs. Waiting for China to reduce its steel output or increase domestic consumption isn’t a viable solution—European steelmakers won’t automatically become more competitive in such a scenario.”

The situation highlights a pressing need for global producers to innovate and adapt to withstand the growing dominance of Chinese steel in the international market.

25th floor, C3 Building, Wanda Plaza, Kaifu District, Changsha, Hunan Province, China